Another quick update to this series of posts. Credit spreads continue to narrow. Very good news, since it means that default risk is falling, and that is because the outlook for the economy is brightening. A recovering economy and accommodative monetary policy add up to a wonderful tonic for corporate bond investors.

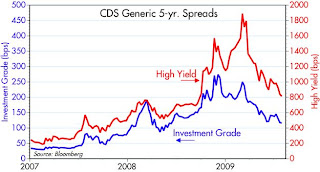

Another quick update to this series of posts. Credit spreads continue to narrow. Very good news, since it means that default risk is falling, and that is because the outlook for the economy is brightening. A recovering economy and accommodative monetary policy add up to a wonderful tonic for corporate bond investors.Note that the gap between junk spreads and investment grade spreads (second chart) has fallen by more than half since early March, which not coincidentally was the bottom of the equity market. The stock and corporate bond markets are saying exactly the same thing: this recovery in the prices of risky assets is the real thing. This sort of price action is highly significant and won't be easily derailed. Why? Because the financial crisis of last year was fundamentally a crisis of confidence, an extreme fear of counterparty risk; the dramatic narrowing of credit spreads is the best sign yet that this crisis of confidence has passed. As a result, all the money that went into hiding during the crisis is now returning to the light of day. Money velocity is picking up, and that in turn is lifting the economy. It's a virtuous cycle.

Full disclosure: I am long equities, investment grade bonds, high yield bonds and emerging market bonds via a variety of vehicles at the time of this writing.

No comments:

Post a Comment