3rd Quarter GDP came in stronger than expected (3.0% vs 2.6%) and a bit stronger than the 2.2% growth rate of the current expansion, but the market remains unconvinced that the US economy is indeed accelerating. Tax reform may be on Congress' table, but I can detect few if any signs that the market is optimistic about it happening, or even if it happens, whether it will be a significant positive for the economic outlook. This may sound odd, to be sure, given that the stock market has been posting serial new, all-time highs since mid-2016. But consider that since its pre-recession (late 2007) peak, the S&P 500 is up at an annualized rate of just over 5%—which is lower than its long-term average of just over 6% per year. The market is doing well, of course, but arguably it's not yet in "off the charts" mode.

I've been posting updated versions of this spectacular chart for many years now. It shows clearly how unique the current business cycle expansion has been in the economic history of the US economy. From 1965 through 2007, the US economy grew at a trend rate of about 3.1% per year. It slipped below this trend during recessions, and exceeded the trend during boom times. But it invariably returned to trend given a few years. (Milton Friedman in 1964 wrote a paper about this, calling it the Plucking Model.) The current expansion has been by far the weakest on record. Relative to its previous trend, the US economy is more than $3 trillion smaller than it might have been had things played out this time as they have before.

What's the cause of this underperformance, especially considering that since late 2008 the Fed has massively expanded its balance sheet? My list of reasons lays the blame on two major factors: 1) an oppressive expansion of government, in the form of increased regulatory and tax burdens, and 2) a shell-shocked market that has yet to regain its former level of confidence in the wake of the worst recession since the Depression.

Thanks to TIPS (Treasury Inflation-Protected Securities), which were introduced in 1997, we have real-time knowledge of the market's expectation for risk-free, inflation-adjusted returns. (TIPS pay a real rate of interest in addition to whatever the inflation rate happens to be. The price of TIPS varies inversely with the market level of the real yield on TIPS.) As the chart above shows, the level of real yields on TIPS tends to track the economy's real growth rate, much as common sense would suggest. When economic growth was booming in the late 1990s, TIPS paid a real rate of interest of about 4%, since they had to compete with the market's expectation for 4-5% real economic growth. But with the trend rate of growth having now slowed to just over 2%, the real rate of interest on TIPS is only modestly positive: 0.2% for the next 5 years, as of today. If the market thought the US economy were on track to deliver 3%+ rates of growth in the years ahead, I'm confident that the real yield on 5-yr TIPS would be in the neighborhood of 1-2%, if not higher.

The chart above compares the real yield on 5-yr TIPS (red line) with the ex-post real yield on the Fed funds rate. This is akin to viewing two points on the real yield curve: overnight rates and 5-yr rates. In effect, the red line is the market's expectation for what the real Fed funds rate is going to average over the next 5 years. And of course, the real Fed funds rate is the rate that the Fed is actually targeting. As you can see, the market expects only a very modest amount of tightening from the Fed in the years to come; 2-3 rate nominal rate hikes over the next few years, and hardly any hike at all in real overnight rates. That makes sense only if you believe that both the market and the Fed agree that the economy has very limited upside growth potential. If the market thought the economy were set to grow at a 3%+ rate for the next several years, the market would immediately assume—and the Fed would probably agree—that there would be a series of rate hikes in the future, not just 2 or 3.

The chart above compares the real and nominal yields on 5-yr Treasuries (red and blue lines) with the difference between the two (green line), which is the market's expectation of what the CPI will average over the next 5 years. With 5-yr inflation expectations today at 1.85%, the market is only a tiny bit concerned that the Fed will be unable to hit its 2% inflation target. Looking ahead, the market sees pretty much the same amount of inflation that we have seen over the past few decades. Nothing surprising. The market is thus fairly confident that the Fed is not going to do much going forward, and whatever it does, the Fed is unlikely to be too tight or too easy. You may not agree with that assessment, but that's what the market tea leaves are saying.

The chart above suggests that one reason the market is up is because the market is not very worried about whatever is going on in the world right now. The Vix index is relatively low, and 10-yr Treasury yields are near the high end of their recent range. The combination of the two (red line) suggests a lack of fear and a lack of concern that the economy could decelerate meaningfully.

If the market is not very optimistic about the economy's ability to grow at a significantly faster pace, as the charts above strongly suggest, then it stands to reason that a failure by Trump and the Republicans to pass significant, growth-friendly tax reform would not likely result in a significant equity market selloff. But should they be successful, then the market's upside potential could be significant.

I hasten to add, however, that a stronger economy would perforce result in an unexpected rise in real and nominal interest rates (and more rate hikes from the Fed than are currently anticipated). Higher-than-expected rates would obviously depress bond prices, and, in similar fashion, could depress the market's PE ratio (which is the inverse of the earnings yield on equities, and thus similar to a bond price), thus limiting further gains in equity prices to a rate that is somewhat less than the increase in earnings. So even if Trump and the Republicans are successful, we are probably not on the cusp of a monster equity rally. In other words, the next Wall of Worry could be higher-than-expected interest rates, which would put downward pressure on equity prices because they would imply a higher discount rate and a lower present value of future after-tax corporate profits. That downward pressure on equity prices would probably be offset—though not entirely—by rising earnings.

Friday, October 27, 2017

Friday, October 20, 2017

Not cutting tax rates is boosting the deficit

It's pandering season again, with politicians and journalists wringing their hands about how cutting taxes will be a windfall to the rich and result in higher deficits. The truth, however, is that by NOT cutting taxes the federal government is losing money and the economy is suffering from sluggish growth. Cutting taxes would almost surely result in a significant boost in revenues and stronger growth. How do I know this? Since early last year (February 2016, to be exact), when talk of tax cuts began to spread and politicians on both sides of the aisle began to agree that our corporate tax rate—the highest in the developing world—should be cut, revenues from corporate and individual income taxes have flatlined, despite the fact that personal incomes have increased by almost 5%, trailing earnings per share have increased 8%, and the stock market has jumped some 30%.

It's amazing: rising incomes, rising profits, and soaring asset prices have resulted in no increase in revenues to the federal government, even though tax rates weren't cut. How could that possibly happen? Simple: people are rational, and they respond to incentives. Given the incentive that tax rates may be reduced in the future, individuals and corporations have apparently taken steps to reduce their current tax liabilities by delaying income, accelerating deductions, postponing investments, and postponing the realization of profits.

Consider these simple facts: S&P 500 trading volume has plunged over 40% since early last year. One reason stocks are up is that people are increasingly reluctant to sell; on the margin they would rather postpone the realization of their gains in order to minimize their current income tax liability. I can assure you that has been a powerful motivator for me, and I'll wager that there are millions of investors who would agree. It's no wonder that NYSE member firms report a 25% increase in margin balances since Feb. '16 (from $436 billion to $551 billion) after no increase over the previous two years. Need income but don't want to pay capital gains taxes? Just don't sell anything and instead add to your margin balance.

Here are some charts which fill out the story:

The chart above shows the rolling 12-month totals of federal spending and federal revenues. Spending has been increasing steadily for the past several years, roughly in line with the growth of the economy. Revenues, however, stopped growing early last year. As a result, the 12-month deficit has increased from $405 billion in February 2016 to $665 billion in September 2017. That's a whopping increase of over 60%!

So, despite ongoing growth in the economy and in incomes, plus surging stock prices, federal revenues have declined by about 1% of GDP since early last year, as the chart above shows. A static model would have projected a significant increase in revenues. No one (especially the OMB, which is still enamored of static forecasting models) expected federal revenues to be flat over the past 18-19 months. But that's what happened.

It's amazing: rising incomes, rising profits, and soaring asset prices have resulted in no increase in revenues to the federal government, even though tax rates weren't cut. How could that possibly happen? Simple: people are rational, and they respond to incentives. Given the incentive that tax rates may be reduced in the future, individuals and corporations have apparently taken steps to reduce their current tax liabilities by delaying income, accelerating deductions, postponing investments, and postponing the realization of profits.

Consider these simple facts: S&P 500 trading volume has plunged over 40% since early last year. One reason stocks are up is that people are increasingly reluctant to sell; on the margin they would rather postpone the realization of their gains in order to minimize their current income tax liability. I can assure you that has been a powerful motivator for me, and I'll wager that there are millions of investors who would agree. It's no wonder that NYSE member firms report a 25% increase in margin balances since Feb. '16 (from $436 billion to $551 billion) after no increase over the previous two years. Need income but don't want to pay capital gains taxes? Just don't sell anything and instead add to your margin balance.

Here are some charts which fill out the story:

The chart above shows the rolling 12-month totals of federal spending and federal revenues. Spending has been increasing steadily for the past several years, roughly in line with the growth of the economy. Revenues, however, stopped growing early last year. As a result, the 12-month deficit has increased from $405 billion in February 2016 to $665 billion in September 2017. That's a whopping increase of over 60%!

The chart above shows the major sources of federal revenues (it excludes things such as excise and customs taxes, and miscellaneous revenues, all of which are down somewhat). The only revenue category that has been increasing steadily for the past few years is Payroll Taxes (i.e., income tax withholding), by about 5% per year. That's very much in line with the growth of wages and salaries, which have been increasing at a 3.8% annual rate since Feb. '16. The thing that is unique with payroll taxes is that individuals don't have much discretion over their reported income. If their salary goes up, their withholding is going to go up as well. But individual income taxes are different. They are impacted by deductions, which can be shifted in time, as well as capital gains taxes, which can be legally postponed indefinitely, simply by not selling an appreciated asset. The rich can employ a variety of strategies to postpone or defer their income.

As it turns out, revenues from individual income taxes have experienced zero growth since Feb. '16, despite ongoing growth in personal income and sharply rising stock prices. Corporate income tax revenues have actually declined by about 10% since Feb. '16, despite an 8% rise in trailing, after-tax EPS over the same period. If you were the head of a large corporation and you thought there was a good chance of a meaningful cut in corporate income taxes, wouldn't you take all available steps to postpone income and accelerate deductions? Is it any wonder that US corporations have refused to repatriate trillions of overseas profits?

So, despite ongoing growth in the economy and in incomes, plus surging stock prices, federal revenues have declined by about 1% of GDP since early last year, as the chart above shows. A static model would have projected a significant increase in revenues. No one (especially the OMB, which is still enamored of static forecasting models) expected federal revenues to be flat over the past 18-19 months. But that's what happened.

As the chart above shows, the rolling 12-month federal budget deficit has increased from $405 billion in Feb. '16 to $666 billion in Sep. '17. Relative to GDP, the federal deficit has increased from 2.4% to 3.4%. And it's ALL due to zero growth in tax receipts, which occurred despite no reduction in tax rates and sizable increases in incomes and capital gains.

It's only reasonable to conclude that the reason federal revenues have failed to materialize as would have been expected is that people and corporations have taken meaningful steps to postpone income, accelerate deductions, and postpone the realization of capital gains. And they have done all that because they have been thinking there was a decent chance of significant tax reform.

It's a safe bet that if the tax code is reformed, and marginal tax rates on incomes, capital gains, and corporate profits are reduced, Treasury will see an almost immediate surge in revenue. Tax reform would unleash a wave of profit-taking, a surge of capital gains realizations, a massive redeployment of capital to more productive uses, more investment (reducing taxes increases the after-tax returns to investment, thus prompting more investment), more risk-taking, more work, more growth, and ultimately reduced budget deficits. I'm not talking ideology, I'm just talking basic common sense.

But won't the rich get the bulk of the benefit from lower tax rates? Sure, because the top 10% of income earners pay about 70% of all income taxes, and half the working population pays zero income tax. Anyway, wouldn't you rather let a rich person keep more of his money, instead of giving it to the politicians in Washington? Who do you think would spend a million dollars more productively: a rich person who is already consuming as much as he or she wants, or a politician, who would love to buy votes? When the rich keep more of their hard-earned money, they almost certainly will invest most or all of it, and that's what creates jobs and prosperity. When politicians get a windfall of revenues, they will spend it, and don't forget that over 70% of every dollar that Congress spends goes out in the form of transfer payments (i.e., money given to people who haven't worked for it).

Congress needs to cut taxes in order to boost revenues and stimulate the economy. Quickly! We can't afford to wait.

UPDATE: Art Laffer has made this same point repeatedly over the years when explaining the mistake that Reagan made in phasing in his tax cuts. If you promise that tax rates will fall in the future, you only weaken the economy today. When lower tax rates make sense, as they do today (especially corporate tax rates) rates need to be cut ASAP, otherwise capital will go dormant, awaiting the lower rates.

Thursday, October 19, 2017

A Goldilocks dollar?

I've had a number of posts over the years that have looked at the value of the dollar vis a vis other currencies. One common thread in these posts has been a reference to each currency's Purchasing Power Parity (PPP), which in theory is the exchange rate which would make prices roughly comparable between two countries. Since the mid-1980s I've used the same methodology for estimating this value, and I've been continually impressed with how it's held up over time. Since I started this blog in late 2008, the dollar has been all over the map: plunging to its weakest level ever in 2011, then soaring over the subsequent five years to its late-2016 high. My PPP analysis says that today the dollar is pretty close to what could be called "fair value" against most of the major currencies, with the notable exception being the Australian dollar, which I estimate to be trading about 25% above my estimate of its PPP value vis a vis the dollar.

To calculate a currency's PPP value against the dollar, I first look for a period—a base year—when prices in that country were roughly comparable to prices in the US. I then adjust the value of the currency in the base year for the difference in inflation between that country and inflation in the US over time. If a country has lower inflation than the US, its PPP value will rise over time, and if a country has more inflation than the US, its PPP value will decline. I should add that I've had occasion to visit each country over the years, and have been able to validate my PPP estimate by subjectively comparing how prices for food, clothing, hotels, etc. compare to US prices (there's an element of judgment at work here, but I think most observers would agree that my estimate of PPP is not too far off—comments pro and con are welcome). As you can see in the charts below, a currency rarely trades at or near its PPP. Instead, most currencies tend to cycle up and down relative to their PPP value, becoming alternately strong and then weak. One important caveat: although divergences between a country's PPP rate and its actual exchange rate tend to close and even reverse over time, PPP should not be used to bet on a currency's future strength or weakness, since it can take years for conditions to change. This is not a trading tool, it's a way to judge how strong or weak a currency is at any one time.

I begin with the Fed's calculation of the dollar's inflation-adjusted value vis a vis a trade-weighted basket of currencies. This is arguably the single best measure of the dollar's overall strength or weakness. The blue line measures the dollar against a basket of more than 100 currencies, while the purple line compares it to a basket of about a dozen currencies. Against a broad basket of currencies the dollar is today is roughly equal to its average since 1973. Relative to the largest currencies, the dollar is about 5-10% above its long-term average. Call it a Goldilocks dollar: neither too strong nor too weak.

The chart above shows how the Euro has tracked its PPP over time. The Euro began in 1997, but I extended its value back in time using the DM as a proxy. Note that the Euro's PPP has trended upwards against the dollar over many decades, a reflection of the fact that Europe has had less inflation than the US. Today the Euro is trading at almost exactly my estimate for its PPP. US visitors to Europe should find that prices there are pretty similar to prices here. Similarly, European visitors to the US should not be surprised to find things cost about the same here as in Europe.

As the first chart above shows, Japan has had a lot less inflation than the US since the late 1970s, and the yen has been very strong throughout most of that period. Some would say the Bank of Japan has been too tight, keeping inflation too low and the yen to strong, and that in turn has curtailed economic growth by making Japanese exports expensive, among other things. In any event, the yen is no longer too strong. As the second chart shows, the yen may now be at a level that is allowing the economy to pick up. Note that the stock market has surged in the past year or so, even as the yen has strengthened a bit.

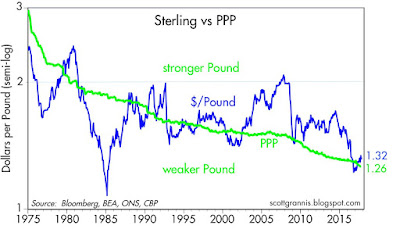

As the chart above shows, the UK has experienced a lot more inflation than the US in the past several decades; as a result the Pound has been in a long-term, declining trend vis a vis the dollar. Currently the Pound is trading very close to my estimate of PPP. Traveling to the UK in the mid-2000s, as I did frequently, was a painful experience since prices were very expensive. Today it's a much nicer experience.

As the first chart above shows, Canada's inflation has been very similar to US inflation for the past 30 years. However, the Canadian dollar has been all over the map—very weak in the early 2000s, and extremely strong in the late 2000s. The strength or weakness of the Canadian dollar has tended to be the mirror opposite of the dollar's strength or weakness, and both have been highly correlated—until recently—with commodity prices, as the second chart above shows. (Canada positively correlated, the US dollar negatively correlated)

Finally, we come to the Australian dollar, which by my calculations is trading about 25% above its PPP value vis a vis the dollar. Australia continues to benefit from strong commodity prices and from strong demand from China. But the loonie is no longer egregiously strong, as it was some 5 years ago.

At current levels, exchange rates paint a picture of a global economy that is rough equilibrium. No country, with the possible exception of Australia and a few others—is judged by the market to be inherently more attractive than others, on a risk-adjusted basis, and thus worthy of a relatively strong currency. Currency risk has ebbed, as a result, and this may contribute to a continuation of global growth (less risk tends to favor investment, which in turn is the engine of growth). Altogether, not a bad state of affairs.

To calculate a currency's PPP value against the dollar, I first look for a period—a base year—when prices in that country were roughly comparable to prices in the US. I then adjust the value of the currency in the base year for the difference in inflation between that country and inflation in the US over time. If a country has lower inflation than the US, its PPP value will rise over time, and if a country has more inflation than the US, its PPP value will decline. I should add that I've had occasion to visit each country over the years, and have been able to validate my PPP estimate by subjectively comparing how prices for food, clothing, hotels, etc. compare to US prices (there's an element of judgment at work here, but I think most observers would agree that my estimate of PPP is not too far off—comments pro and con are welcome). As you can see in the charts below, a currency rarely trades at or near its PPP. Instead, most currencies tend to cycle up and down relative to their PPP value, becoming alternately strong and then weak. One important caveat: although divergences between a country's PPP rate and its actual exchange rate tend to close and even reverse over time, PPP should not be used to bet on a currency's future strength or weakness, since it can take years for conditions to change. This is not a trading tool, it's a way to judge how strong or weak a currency is at any one time.

I begin with the Fed's calculation of the dollar's inflation-adjusted value vis a vis a trade-weighted basket of currencies. This is arguably the single best measure of the dollar's overall strength or weakness. The blue line measures the dollar against a basket of more than 100 currencies, while the purple line compares it to a basket of about a dozen currencies. Against a broad basket of currencies the dollar is today is roughly equal to its average since 1973. Relative to the largest currencies, the dollar is about 5-10% above its long-term average. Call it a Goldilocks dollar: neither too strong nor too weak.

The chart above shows how the Euro has tracked its PPP over time. The Euro began in 1997, but I extended its value back in time using the DM as a proxy. Note that the Euro's PPP has trended upwards against the dollar over many decades, a reflection of the fact that Europe has had less inflation than the US. Today the Euro is trading at almost exactly my estimate for its PPP. US visitors to Europe should find that prices there are pretty similar to prices here. Similarly, European visitors to the US should not be surprised to find things cost about the same here as in Europe.

As the first chart above shows, Japan has had a lot less inflation than the US since the late 1970s, and the yen has been very strong throughout most of that period. Some would say the Bank of Japan has been too tight, keeping inflation too low and the yen to strong, and that in turn has curtailed economic growth by making Japanese exports expensive, among other things. In any event, the yen is no longer too strong. As the second chart shows, the yen may now be at a level that is allowing the economy to pick up. Note that the stock market has surged in the past year or so, even as the yen has strengthened a bit.

As the chart above shows, the UK has experienced a lot more inflation than the US in the past several decades; as a result the Pound has been in a long-term, declining trend vis a vis the dollar. Currently the Pound is trading very close to my estimate of PPP. Traveling to the UK in the mid-2000s, as I did frequently, was a painful experience since prices were very expensive. Today it's a much nicer experience.

As the first chart above shows, Canada's inflation has been very similar to US inflation for the past 30 years. However, the Canadian dollar has been all over the map—very weak in the early 2000s, and extremely strong in the late 2000s. The strength or weakness of the Canadian dollar has tended to be the mirror opposite of the dollar's strength or weakness, and both have been highly correlated—until recently—with commodity prices, as the second chart above shows. (Canada positively correlated, the US dollar negatively correlated)

Finally, we come to the Australian dollar, which by my calculations is trading about 25% above its PPP value vis a vis the dollar. Australia continues to benefit from strong commodity prices and from strong demand from China. But the loonie is no longer egregiously strong, as it was some 5 years ago.

At current levels, exchange rates paint a picture of a global economy that is rough equilibrium. No country, with the possible exception of Australia and a few others—is judged by the market to be inherently more attractive than others, on a risk-adjusted basis, and thus worthy of a relatively strong currency. Currency risk has ebbed, as a result, and this may contribute to a continuation of global growth (less risk tends to favor investment, which in turn is the engine of growth). Altogether, not a bad state of affairs.

Wednesday, October 11, 2017

Recent & notable charts

Here is a collection of charts, in no particular order, that I have updated in the past week and which I think are worth noting. If they have a common theme, it's that economies both here and abroad continue to improve.

Today the Japanese stock market reached a two-decade high, after not making much progress on balance for a very long time. It's interesting that this occurred despite the fact that the yen has been strengthening of late against the dollar. As the chart above shows, since 2005 Japanese equities had shown a strong inverse correlation to the value of the yen (e.g., equities would rise as the value of the yen fell, and vice versa). People have made various attempts to explain this inverse correlation, with perhaps the most convincing being that the Bank of Japan has been pursuing misguided monetary policy at times, such that a stronger yen (one result of very tight monetary policy) put a lot of downward price pressure on Japan's industries (because it made their products more expensive to foreign buyers), while a weaker yen mitigated this pressure and eventually became "stimulative." I'm not quite sure what to make of the action offer the past year or so, but I think it may be that the yen has settled into a reasonable valuation zone. Perhaps not coincidentally, my calculation of the Purchasing Power Parity exchange rate between the yen and the dollar is about 114, which is very close to the current exchange rate of 112. This further suggests that central banks have been doing a pretty good job of managing things, and currencies are trading at reasonable levels in general. (The Fed's Real Broad Trade Weighted Dollar index is currently very close to its 45-year average, by the way.) This suggests that the uncertainties that arise from significant currency fluctuations have been mitigated, and that further suggests that economic fundamentals have become more conducive to investment and growth. Reduced uncertainty is almost always good for investors, and for investments, and for economies.

As the chart above shows, property prices for commercial real estate continue to rise, and have clearly surpassed their prior peak. You hear a lot these days about how shopping malls are dying all over the country (thanks to predators such as Amazon), but this suggests that things are not necessarily bad at all in general.

The charts above are based on Bloomberg's calculation of equity market capitalization. I note that non-US equity markets have been strongly outperforming their US counterparts for most of the past year. However, all markets have registered equivalent gains for the past decade or so, on balance. We're in a global recovery that shows every sign of continuing.

The September ISM survey of service sector businesses in the US was extremely strong, as the chart above shows. This could well be one of those random blips, but at the very least it suggests that the US economy continues to improve. It's also worth noting that a similar index of Eurozone service sector businesses has been trending higher for the past several years. It looks like we're in a synchronized global growth cycle.

I've commented often and for years about the curious and continuing dance between gold and TIPS prices, as illustrated in the above chart (see a recent post here). I've also commented on how the real yield on 5-yr TIPS (shown inversely in the chart in order to serve as a proxy for their price) tends to move in line with the real growth trend of the US economy. With 5-yr TIPS real yields only slightly above zero, the market is apparently unconvinced that any good will come from the Trump administration, at least insofar as something that might push the US economy out of its 2% real growth rut. If there is anything that makes a convincing rebuttal to the widespread claims that the market is insanely optimistic and egregiously overpriced, this chart is it. If the market were convinced that the economy was on the cusp of growing 3% per year or more, I think real yields would be significantly higher and gold prices would be significantly lower.

The most recent survey of small business optimism showed a downtick, but the index is still at rather lofty levels. Small business owners are already seeing a reduction in regulatory burdens, as are banks. It may well be the case that entrepreneurs are already gearing up for better things ahead, but that we won't see the results (e.g., more hiring, more investment) for some months to come. These things take time to unfold.

The message of this chart is that the real value of the S&P 500 index has increased in line with the physical expansion of the US economy for the past 45 years. As a proxy for the economy's physical size, I've used the American Trucking Association's index of total truck tonnage hauled by the nation's truckers. I note that there have been a few times when equity markets have diverged significantly from the the trucking index, particularly the late 1980s, the late 1990s, and during the depths of the 2008-2009 recession. I would characterize those as periods of excessive optimism and pessimism—sentiment not warranted by the progress of the overall economy. Currently, the advance in equity valuations seems to be very much in line with the growth of the economy.

Today the Japanese stock market reached a two-decade high, after not making much progress on balance for a very long time. It's interesting that this occurred despite the fact that the yen has been strengthening of late against the dollar. As the chart above shows, since 2005 Japanese equities had shown a strong inverse correlation to the value of the yen (e.g., equities would rise as the value of the yen fell, and vice versa). People have made various attempts to explain this inverse correlation, with perhaps the most convincing being that the Bank of Japan has been pursuing misguided monetary policy at times, such that a stronger yen (one result of very tight monetary policy) put a lot of downward price pressure on Japan's industries (because it made their products more expensive to foreign buyers), while a weaker yen mitigated this pressure and eventually became "stimulative." I'm not quite sure what to make of the action offer the past year or so, but I think it may be that the yen has settled into a reasonable valuation zone. Perhaps not coincidentally, my calculation of the Purchasing Power Parity exchange rate between the yen and the dollar is about 114, which is very close to the current exchange rate of 112. This further suggests that central banks have been doing a pretty good job of managing things, and currencies are trading at reasonable levels in general. (The Fed's Real Broad Trade Weighted Dollar index is currently very close to its 45-year average, by the way.) This suggests that the uncertainties that arise from significant currency fluctuations have been mitigated, and that further suggests that economic fundamentals have become more conducive to investment and growth. Reduced uncertainty is almost always good for investors, and for investments, and for economies.

As the chart above shows, property prices for commercial real estate continue to rise, and have clearly surpassed their prior peak. You hear a lot these days about how shopping malls are dying all over the country (thanks to predators such as Amazon), but this suggests that things are not necessarily bad at all in general.

The charts above are based on Bloomberg's calculation of equity market capitalization. I note that non-US equity markets have been strongly outperforming their US counterparts for most of the past year. However, all markets have registered equivalent gains for the past decade or so, on balance. We're in a global recovery that shows every sign of continuing.

The September ISM survey of service sector businesses in the US was extremely strong, as the chart above shows. This could well be one of those random blips, but at the very least it suggests that the US economy continues to improve. It's also worth noting that a similar index of Eurozone service sector businesses has been trending higher for the past several years. It looks like we're in a synchronized global growth cycle.

I've commented often and for years about the curious and continuing dance between gold and TIPS prices, as illustrated in the above chart (see a recent post here). I've also commented on how the real yield on 5-yr TIPS (shown inversely in the chart in order to serve as a proxy for their price) tends to move in line with the real growth trend of the US economy. With 5-yr TIPS real yields only slightly above zero, the market is apparently unconvinced that any good will come from the Trump administration, at least insofar as something that might push the US economy out of its 2% real growth rut. If there is anything that makes a convincing rebuttal to the widespread claims that the market is insanely optimistic and egregiously overpriced, this chart is it. If the market were convinced that the economy was on the cusp of growing 3% per year or more, I think real yields would be significantly higher and gold prices would be significantly lower.

The most recent survey of small business optimism showed a downtick, but the index is still at rather lofty levels. Small business owners are already seeing a reduction in regulatory burdens, as are banks. It may well be the case that entrepreneurs are already gearing up for better things ahead, but that we won't see the results (e.g., more hiring, more investment) for some months to come. These things take time to unfold.

As the chart above shows, car sales had been in a disturbing slump since last year. Fortunately, the September numbers revealed a substantial bounce. This may be just one of those quirks of seasonal adjustments, so we'll have to wait for a few more months to declare victory, but it is nevertheless encouraging.

Saturday, October 7, 2017

Healthy households

A few weeks ago, I had some charts (the last two in this post) that showed how our net worth as a country on a real and per capita basis has reached new all-time highs. Our collective prosperity rests on the value of our savings, our investments, and our capital stock. Regardless of who owns all that money (as of June 2017 the net worth of the private sector was over $96 trillion, with total assets worth over $111 trillion), we all enjoy the fruits of those assets in the form of jobs, services, products, and infrastructure. Does a worker really care who owns the building he works in? Who pays his salary? Who owns the toll road he drives to work on? Who owns the tools he uses? He shouldn't. What's important is that the assets that have generated our record-setting wealth are available to all of us, everyday.

The Fed recently updated its calculation of households' debt service burdens, as of Q2/17. Total household liabilities climbed to a record $15.2 trillion, but that represents less than 14% of total household assets. As the charts below show, households' financial burdens (the cost of servicing debt as a percent of disposable income) are about as low as they have been for decades. And households' overall leverage (total debt as a percent of total assets) has fallen by one-third since its record high in early 2009.

On balance, U.S. households are in very healthy financial shape, and that in turn means that the fundamentals of the U.S. economy are also in good shape.

The Fed recently updated its calculation of households' debt service burdens, as of Q2/17. Total household liabilities climbed to a record $15.2 trillion, but that represents less than 14% of total household assets. As the charts below show, households' financial burdens (the cost of servicing debt as a percent of disposable income) are about as low as they have been for decades. And households' overall leverage (total debt as a percent of total assets) has fallen by one-third since its record high in early 2009.

On balance, U.S. households are in very healthy financial shape, and that in turn means that the fundamentals of the U.S. economy are also in good shape.

Subscribe to:

Posts (Atom)